FLORATI V&C SRL

Florati simplifies procurement for industrial departments by supplying nonstrategic products, including cutting tools, safety equipment, and more, serving major clients like Still Material Handling and a dairy factory.

Seeking Funds or Pursuing Profits? Let’s thrive financially together. Join the Fagura Community!

Create accountGet a loan 100% online, hassle-free, without any paperwork and trips to the bank required. Interest rates starting from 6.5%

BorrowStart from 25 euros and handpick your investment opportunities. Diversify your portfolio effortlessly with Auto Invest

Invest

Investors lend directly to companies that are looking for fast loans or refinancing online. An investor funds multiple companies to reduce his risk.

Investors receive monthly payments from borrowing companies, consisting of the loan principal and the interest. These funds can be reinvested or withdrawn from the investor account. The choice is yours!

On Fagura, investors and borrowers support each other’s financial growth. Algorithms assess loan applications objectively, analyse credit histories, calculate interest rates, and assign risk scores.

Fagura assigns the payments received to each of the investors. In case of outstanding payments, we employ loan recovery procedures at the highest market standard.

Entrepreneurs seeking business financing can easily apply for a loan online on Fagura. If approved, multiple investors on the platform will fund the loan.

Companies pay their instalments on a monthly basis according to the payment schedule attached to the loan contract. The advantage: they build a positive credit history.

Choose to grow financially with Fagura through online loans

Below are some of the investment opportunities available on the platform. You can invest anytime, starting from 25 euros.

Florati simplifies procurement for industrial departments by supplying nonstrategic products, including cutting tools, safety equipment, and more, serving major clients like Still Material Handling and a dairy factory.

Extinderea gamei de vinuri premium prin închiderea unui împrumut strategic.

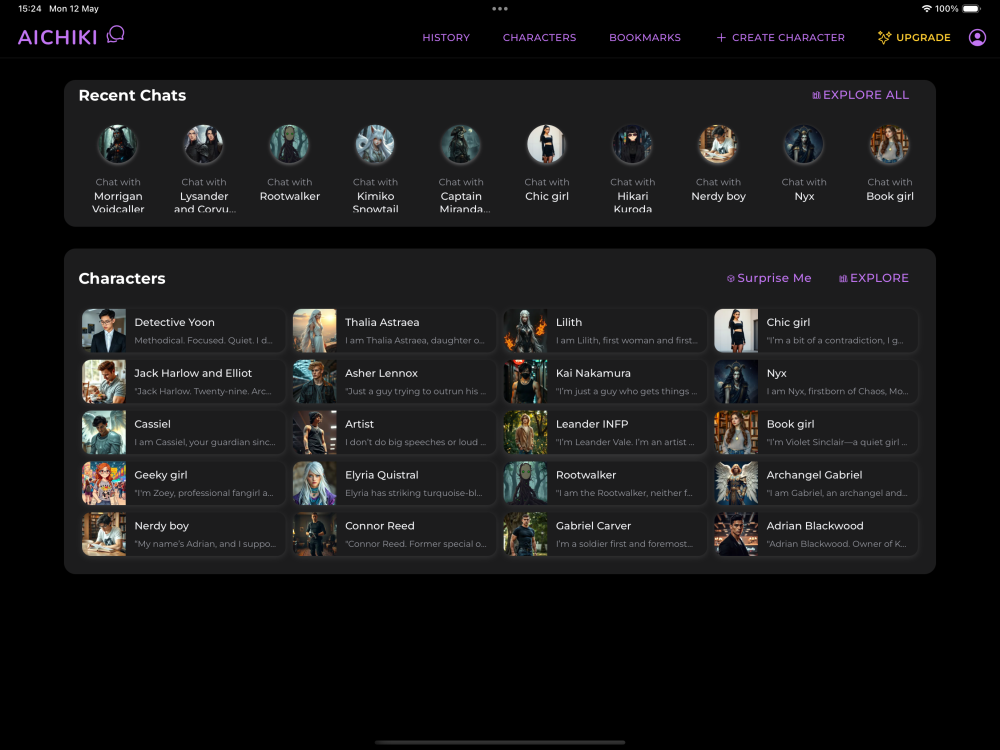

aichiki.ai este o aplicație de chat cu personaje AI, similară cu character.ai,cu accent pe roleplay, personalizare și respect față de utilizatori.

Platform pentru achiziționarea eficientă de mărfuri, facilitând accesul la produse de calitate la prețuri competitive.

Use the calculator below to check the figures for a loan on our platform. Bear in mind that these numbers are just estimates, and you will have an exact calculation when applying for a loan.

*Bear in mind some important general info: The minimum term for granting a loan on Fagura is 12 months, and the maximum term is 48 months. If you have a good credit history, the minimum Annual Percentage Rate (APR) will be around 6.5%, in the case of a bad credit history - the maximum Annual Percentage Rate (APR) will be 38.9%. To make it easier for you in understanding the figures, please find below an example:

Example calculation: Let's say you have a good credit history and you need to borrow €1000. If your request is aproved, you will get €1000 and will have to return back a total of €1071.24, which includes the interest. You will have to return the funds during 12 months, by paying €89.27 monthly. Your annual interest will be 12.9% (APR). But that's an example. To find out your exact quote, you will need first to complete a loan application.

Working hours: Monday - Friday: 9.00 - 18.00

Credit applications can be submitted online 24/7

Investing in crowdfunding projects involves risks, including the risk of partial or total loss of the invested funds. Your investment is not covered by deposit guarantee schemes established in accordance with the Directive 2014/49/EU of the European Parliament and of the Council. Also, your investment is not covered by investor compensation schemes established in accordance with the Directive 97/9/EC of the European Parliament and of the Council. Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell your investments when you want to. If you are able to sell them, you may still make a loss.

Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell the investment instruments when you want to. If you are able to sell them, you may still make a loss.