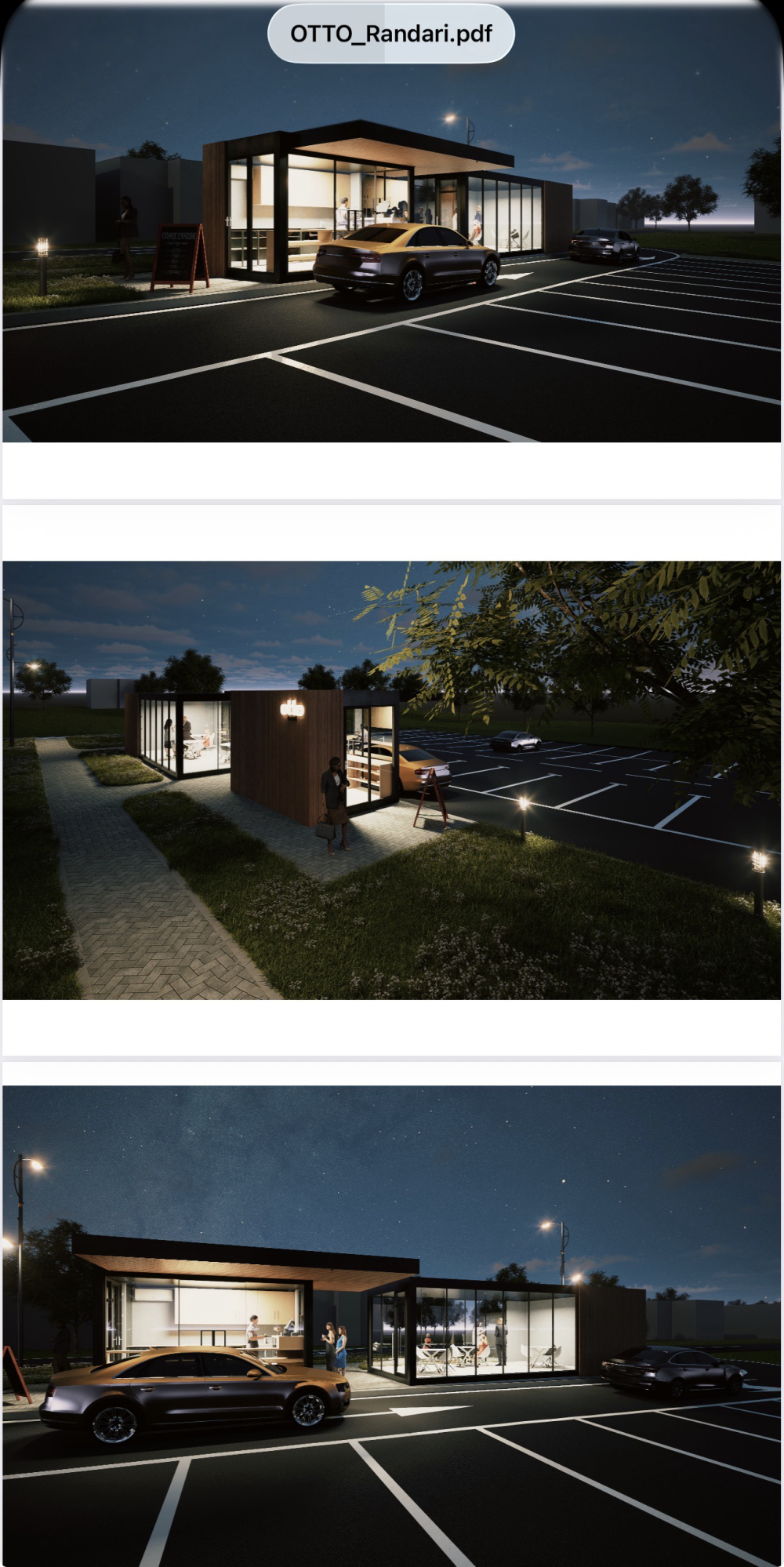

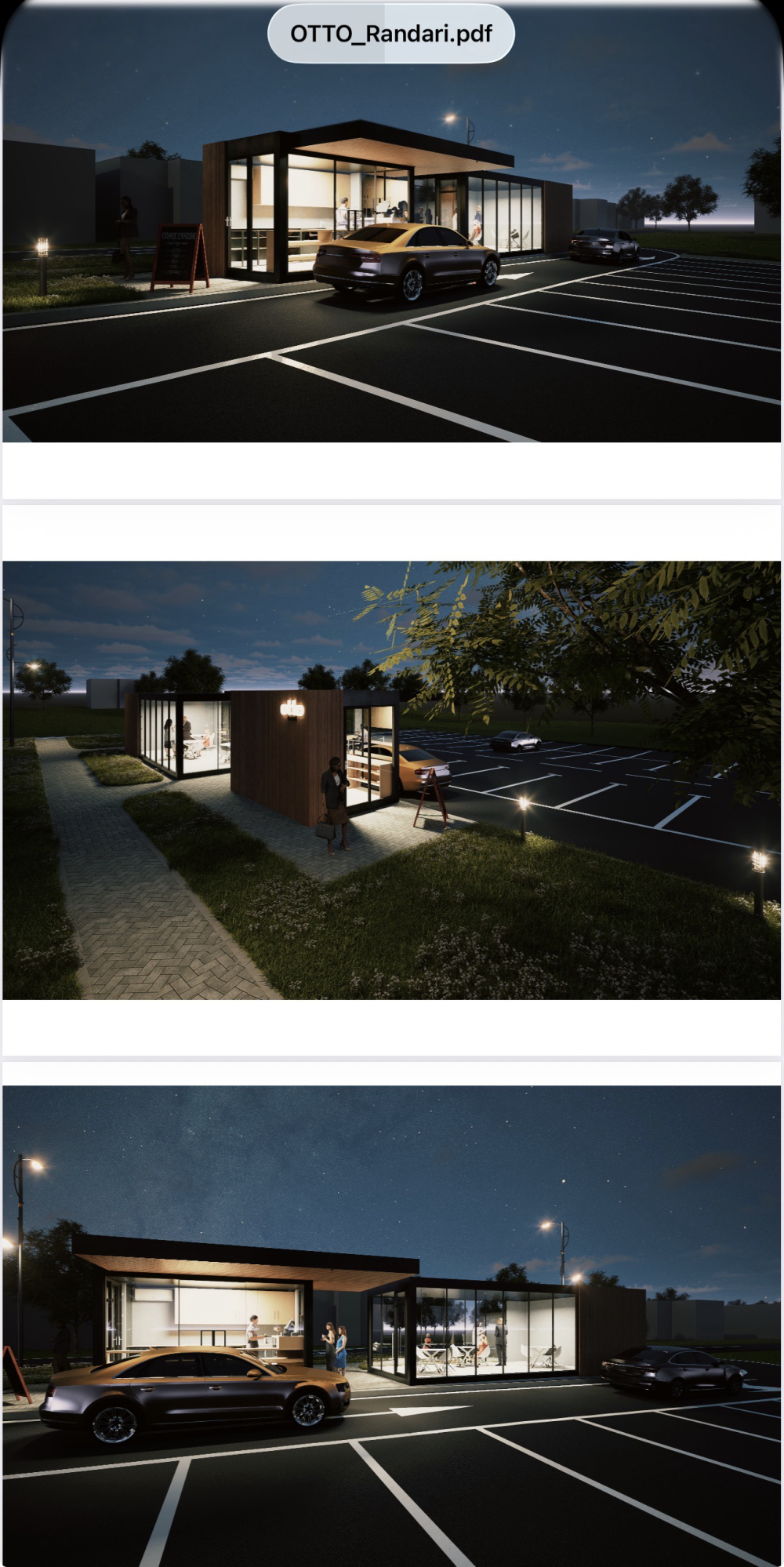

RENAT CAFE

Otto Café oferă cafea de specialitate și fast-food proaspăt, adresându-se studenților și publicului urban, cu scopul de a moderniza operațiunile și a extinde capacitatea de servire.

Get funding directly from investors, fast and hassle-free. Get rid of bureaucracy and trips to the bank. You sign digitally and borrow online with a fixed interest rate.

Create account

*Bear in mind some important general info: The minimum term for granting a loan on Fagura is 12 months, and the maximum term is 48 months. If you have a good credit history, the minimum Annual Percentage Rate (APR) will be around 6.5%, in the case of a bad credit history - the maximum Annual Percentage Rate (APR) will be 38.9%. To make it easier for you in understanding the figures, please find below an example:

Example calculation: Let's say you have a good credit history and you need to borrow €1000. If your request is aproved, you will get €1000 and will have to return back a total of €1071.24, which includes the interest. You will have to return the funds during 12 months, by paying €89.27 monthly. Your annual interest will be 12.9% (APR). But that's an example. To find out your exact quote, you will need first to complete a loan application.

Choose to grow financially with Fagura through online loans

Investors can lend small amounts to several Romanian SMEs. The interest paid by the borrowers goes back to them as profit. Fagura manages the connection between entrepreneurs who want to grow their businesses and investors who want to increase their income by supporting Romanian companies. At Fagura, we emphasise the potential of each company, irrespective of its age.

In short: you can take the loan fastfast, without paperwork or going anywhere, directly from people who believe in your business plan and want to grow financially with you.

Otto Café oferă cafea de specialitate și fast-food proaspăt, adresându-se studenților și publicului urban, cu scopul de a moderniza operațiunile și a extinde capacitatea de servire.

Proiectul nostru vizează dezvoltarea unei surse de energie verde, contribuind la sustenabilitate și crearea de locuri de muncă.

Proiectul vizează refinanțarea unei obligații financiare pentru a reduce costurile și a investi în dezvoltarea comercializării utilajelor agricole.

Refinantare

Choose to grow financially with Fagura through online loans

Proiectul își propune să furnizeze soluții eficiente de tâmplărie din aluminiu și PVC, combinând designul modern cu performanțe energetice ridicate.

Oferim condimente și mixuri de legume sub un brand personal, cu rețete unice, vândute online și pe platforme populare.

Curățătorie specializată în recondiționarea pernelor și pilotel din puf, cu expansiune rapidă în orașe din România.

Oferim încălțăminte din piele naturală, diversificată, pentru bărbați și femei, adaptată schimbărilor sezoniere, printr-o colaborare solidă cu Otter distribution.

Working hours: Monday - Friday: 9.00 - 18.00

Credit applications can be submitted online 24/7

Investing in crowdfunding projects involves risks, including the risk of partial or total loss of the invested funds. Your investment is not covered by deposit guarantee schemes established in accordance with the Directive 2014/49/EU of the European Parliament and of the Council. Also, your investment is not covered by investor compensation schemes established in accordance with the Directive 97/9/EC of the European Parliament and of the Council. Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell your investments when you want to. If you are able to sell them, you may still make a loss.

Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell the investment instruments when you want to. If you are able to sell them, you may still make a loss.