MARKETPLACE SOCIETY SRL

Marketplace Society transformă emoțiile clienților în produse unice prin personalizări textile, oferind valoare estetică și sentimentală.

You choose which companies to finance, how much to invest and for how long. Estimated annual returns in excess of 12% with a diversified portfolio. Exit anytime you want.

Create account

Choose to grow financially with Fagura through online loans

Choose to grow financially with Fagura through online loans

Marketplace Society transformă emoțiile clienților în produse unice prin personalizări textile, oferind valoare estetică și sentimentală.

Achiziția unei noi francize Profi va extinde afacerea, oferind servicii diverse și sprijinind comunitatea locală. Aceasta va consolida statutul firmei pe piață.

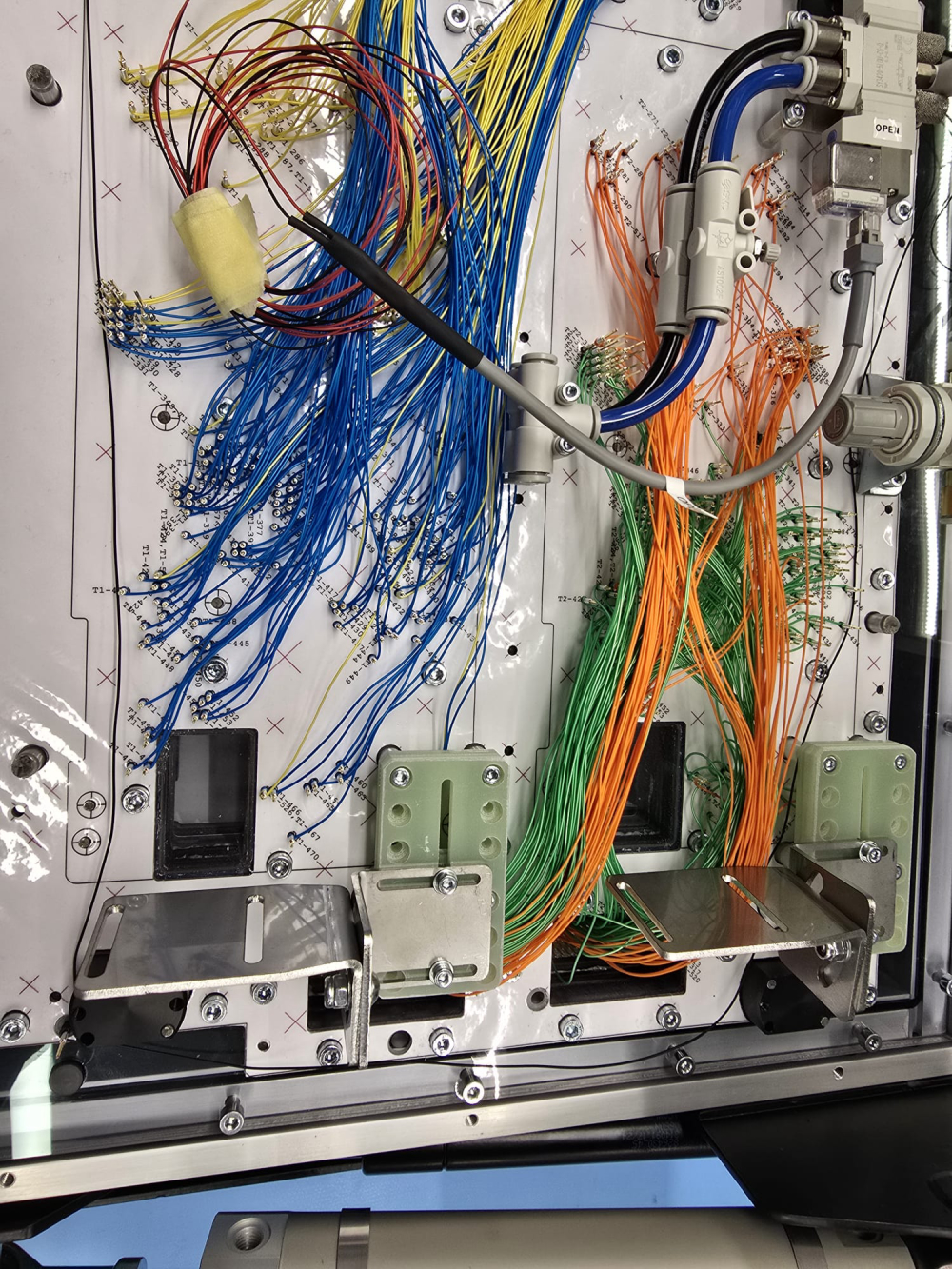

Atelierul nostru de servicii electronice și optice oferă soluții de calitate, demonstrând o creștere constantă a profitului din 2021.

Dezvoltarea unui studio video specializat în casting și producție, oferind servicii inovatoare în domeniul audiției și managmentului talentelor.

Working hours: Monday - Friday: 9.00 - 18.00

Credit applications can be submitted online 24/7

Investing in crowdfunding projects involves risks, including the risk of partial or total loss of the invested funds. Your investment is not covered by deposit guarantee schemes established in accordance with the Directive 2014/49/EU of the European Parliament and of the Council. Also, your investment is not covered by investor compensation schemes established in accordance with the Directive 97/9/EC of the European Parliament and of the Council. Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell your investments when you want to. If you are able to sell them, you may still make a loss.

Your investment may not generate any income. This is not a savings product and we advise you not to invest more than 10% of your net capital in crowdfunding projects. You may not be able to sell the investment instruments when you want to. If you are able to sell them, you may still make a loss.